In the crypto world, the “whales“are individuals or organizations that hold huge amounts of a particular crypto-currency.

They typically own more than 10% of crypto-currencies. For example, MicroStrategy owns nearly 130,000 bitcoins (BTC) and can move the price of BTC through its participation in the market. With their buying and selling power, crypto whales can influence the price of respective crypto tokens and disrupt crypto markets with relative ease.

Investment firms such as Pantera Capital, Fortress Investment Group and Falcon Global Capital are examples of these whales in the crypto-currency market. If they buy a crypto-currency token en masse, the price of that token will rise. Conversely, if they dump a token, the price of that token will drop significantly.

Most crypto-currency whales do not trade on traditional crypto-currency exchanges, as their massive orders are likely to overwhelm the existing volume in the order books. Instead, they trade coins outside of the exchanges’ order books, in a practice known as over-the-counter (OTC) trading.

Whales hold significant power in blockchain governance procedures on Proof-of-Stake (PoS) blockchains (more funds involved gives them more voting power). The presence of whales in these networks could be a good sign (in terms of stability), as they have a strong incentive to act honestly and help the network thrive. On the other hand, the fact that whales control the majority of funds may have a negative impact on the centralization of power.

Monitoring crypto whale trading activity

Because crypto-currencies were designed to offer a greater degree of anonymity, it is difficult to directly link accounts to individual people or organizations. As a result, it is difficult to identify who each whale is, where they live, what work they do, what institution they belong to, and why they are making that transaction.

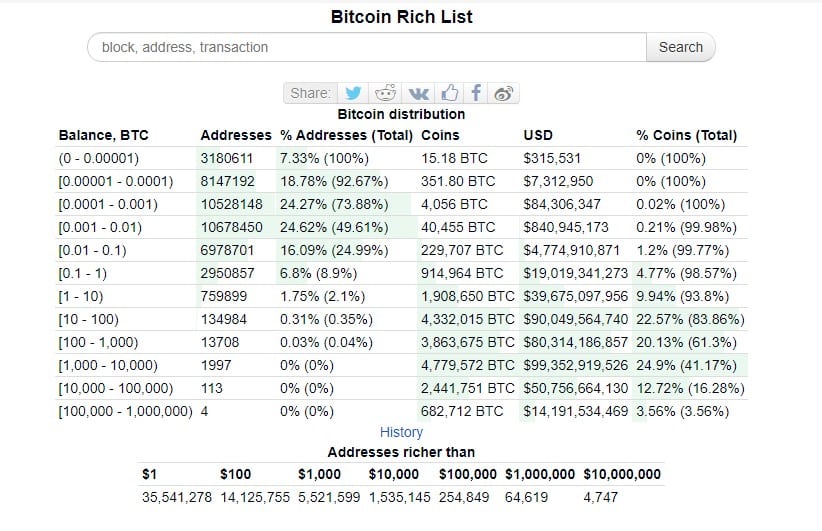

However, by inspecting the blockchain data of those who have made their addresses public, it is possible to identify at least some of the individuals who hold considerable amounts of various coins. In fact, many of these individuals are well-known Bitcoin whales.

It is therefore essential for retail crypto-currency investors to monitor the larger portfolios and stay on top of major changes in their holdings in order to adjust their trading strategy accordingly.

Siemens issues 1st €60M bond on public blockchain

Siemens issues 1st €60M bond on public blockchain Wall Street on a tear: retail sales data drives the rise

Wall Street on a tear: retail sales data drives the rise Web3 instant messenger SendingMe raises $12.5M

Web3 instant messenger SendingMe raises $12.5M FLOKI doubles in value after Elon Musk tweet

FLOKI doubles in value after Elon Musk tweet Floki’s listing on Binance soon confirmed, here’s why, now might be the time to invest!

Floki’s listing on Binance soon confirmed, here’s why, now might be the time to invest!