The world’s largest crypto-currency, Bitcoin (BTC), has faced heavy selling pressure and is currently holding below $17,000 levels. Another major development is that whale interest in bitcoin has declined, which could be a sign of concern to come.

🐳 #Bitcoins ranging prices have a lot to do with declining whale interest. This chart illustrates how closely $BTC and $1M+ valued whale transactions correlate. If prices continue sliding and a spike occurs, this would be a historically #bullish signal. https://t.co/nDZj3eicRD pic.twitter.com/t7GFIKNpax

– Santiment (@santimentfeed) December 28, 2022

Transactions worth $1 million in bitcoins have reached their lowest level in two years and whales have shown very little interest in selling or accumulating bitcoins. The on-chain data provider Santiment noted. :

The fluctuation in bitcoin prices has a lot to do with the decline in interest in whales. This chart illustrates the close correlation between $BTC and whale transactions worth over $1 million. If prices continue to fall and a spike occurs, it would be a historically #bullish signal.

This scenario is true not only for the big whales, but also for the medium whales. The total number of large trades on the BTC network with values over $100,000 just hit a new annual low of 8040 trades. This clearly reflects the low activity of whales and institutions on the BTC network.

Low investor interest in buying bitcoin

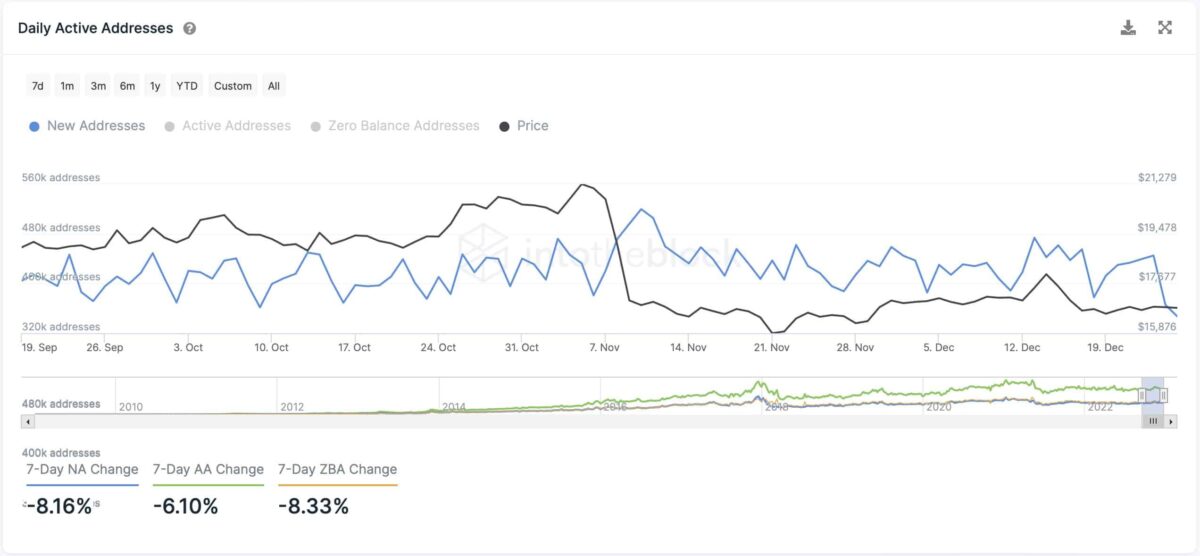

#Bitcoin | Data from @intotheblock shows the number of new addresses created on the $BTC network has been trending down. It has decreased by 8.16% in the past seven days.

This network activity suggests that investors aren’t interested in buying #BTC at the current price levels. pic.twitter.com/BDdtGbzxlB

– Ali (@ali_charts) December 26, 2022

In addition to the whale activity, other data on the blockchain shows that investor interest in buying BTC has also declined. Citing data from IntoTheBlock, the crypto analyst Ali Martinez reported :

“Data from @intotheblock shows that the number of new addresses created on the $BTC network has been trending down. It has decreased by 8.16% in the last seven days. This network activity suggests that investors are not interested in buying #BTC at current price levels.”

Bitcoin’s price volatility has hit a new all-time low, so it has been difficult to predict which way the BTC price will go. Crypto analyst Ali Martinez explains, “Bitcoin is between two major supply walls. One at $16,600 where 1.46 million addresses hold 915K BTC and the other at $17,000 where 1.27 million addresses hold $730KBTC. Sustained movement outside of this area will likely determine the direction of the trend“.

Siemens issues 1st €60M bond on public blockchain

Siemens issues 1st €60M bond on public blockchain Wall Street on a tear: retail sales data drives the rise

Wall Street on a tear: retail sales data drives the rise Web3 instant messenger SendingMe raises $12.5M

Web3 instant messenger SendingMe raises $12.5M FLOKI doubles in value after Elon Musk tweet

FLOKI doubles in value after Elon Musk tweet Floki’s listing on Binance soon confirmed, here’s why, now might be the time to invest!

Floki’s listing on Binance soon confirmed, here’s why, now might be the time to invest!