A number of major players of the cryptocurrency refuse to give information on the corporate governance and the asset conservation from customersaccording to a Financial Times.

The FT published this Tuesday an investigation highlighting the lack of transparency in the cryptocurrency industry.

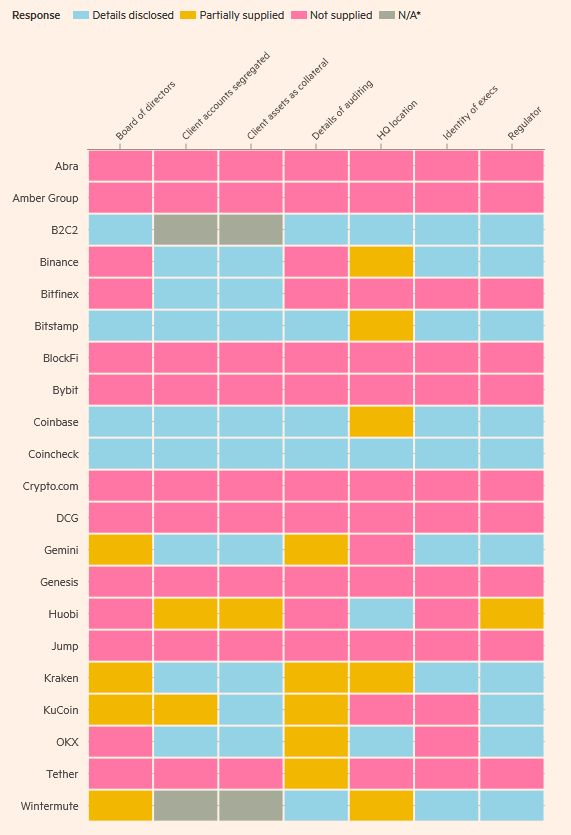

Of the twenty or so large specialist companies surveyed, around a third did not wish to share basic information such as the location of their head office. Some of these companies also supplied partial answers.

The collapse of FTX and other crypto platforms in 2022 raised questions about the compliance with investor protection standards in this new sector, but also on the level of due diligence carried out by certain investment funds.

Among the companies surveyed were the world’s largest crypto exchanges, including Binance, Kraken, Bitfinex, Coinbase and Bitstamp, as well as other giants such as Genesis, Wintermute, DCG, Jump Trading and stablecoin issuer Tether.

Source : Financial Times

Head office locationBoard of directors, main regulatorcompliance and financial management, auditsnumber of employees, asset preservation The questions are numerous, and the precise answers can be found in this document.

It’s a fundamental fear to share information. When we are asked to review a crypto-exchange or custodian, the first thing they often do is get you to sign a non-disclosure agreement,” commented James Newman, co-founder of perfORM Due Diligence Services.

Follow RoyalsBlue.com on TwitterLinkedin, Facebook or Telegram so you don’t miss a thing.

Betiton Casino: A Multi-Award-Winning Casino and Sportsbook in the UK

Betiton Casino: A Multi-Award-Winning Casino and Sportsbook in the UK Binance launchpool to list Ether.Fi project

Binance launchpool to list Ether.Fi project Metamask could offer a crypto payment card with Mastercard

Metamask could offer a crypto payment card with Mastercard Ethereum (ETH) accelerates and flirts with $3,000

Ethereum (ETH) accelerates and flirts with $3,000 Helius raises $9.5M to enhance DApps on Solana

Helius raises $9.5M to enhance DApps on Solana