Tesla shares should be treated as belonging to a Chinese company because 50% of the company’s profits are made in China, Morgan Stanley bank said in a note to investors.

Specifically, according to the source cited, TSLA will behave like a technology sector stock included in the Shanghai Stock Exchange’s SSE Composite Index.

The US bank believes the Elon Musk-led car firm should be seen that way until at least 2030.

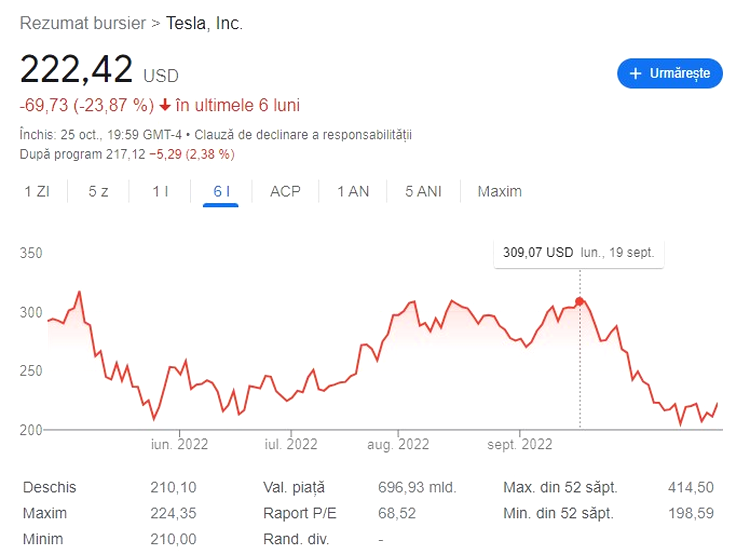

“Tesla will behave like a Chinese stock over the next decade,” Morgan Stanley conveyed. Because of its heavy reliance on the Chinese market, Tesla shares have fallen steeply in recent weeks, in line with other Chinese stocks.

Investors didn’t like the fact that Beijing’s current leader Xi Jinping, who has led China for 10 years, has been empowered for another five-year term at the helm.

That’s why, according to bank analysts, Tesla is vulnerable to tensions between Beijing and Washington, and its shares will continue to be volatile.

Recently, Elon Musk was praised by Chinese Communist government officials after he suggested that Taiwan should become a specially administered region, part of China, like Hong Kong.

Some analysts have said that it is possible that, because of his dependence on China, the American billionaire may be forced to perform certain services for the Communist Party.

Tesla has, in Shanghai, Gigafactory 3, its largest factory.

Via Business Insider

Getting started with a world-famous card game is only cheap today!

Getting started with a world-famous card game is only cheap today! The chain letter warning will also spread in 2026, that’s what’s behind it

The chain letter warning will also spread in 2026, that’s what’s behind it This samurai adventure shows hidden Japan

This samurai adventure shows hidden Japan Switch players can currently almost steal a heist RPG!

Switch players can currently almost steal a heist RPG! I underestimated how worthwhile a good USB charger is

I underestimated how worthwhile a good USB charger is