The FTX heist that occurred hours before Sam Bankman-Fried filed for voluntary Chapter 11 bankruptcy continues to baffle investigators around the world. With nearly a million people affected by the FTX hack, global regulators and blockchain analytics companies are taking initiatives to solve the conundrum.

On Monday, PerkShield Inc – a data analytics and blockchain security company – tweeted that the FTX miner had transferred 180,000 ETH worth about $200 million. According to on-chain data, the FTX hacker transferred the stolen funds in batches of 15,000 ETH. While some funds remain blocked by some crypto projects like Tether (USDT), the FTX exploiter is close to liquidating the majority of the coins.

The FTX hacker used blockchain bridges to move the stolen funds with minimal fuss. While nearly $200 million is on the Ethereum network, the other half has been spread across various blockchains to make the work of investigators more cumbersome.

According to a new Bloomberg article, the FTX implosion could have been prevented months before it happened. The FTX exchange was reportedly under investigation by federal prosecutors in Manhattan months before the collapse. Nonetheless, FTX and its subsidiaries are well connected in the political class thanks to Bankman-Fried’s generous donations, which amount to $40 million in 2022.

Will FTX customers ever be compensated?

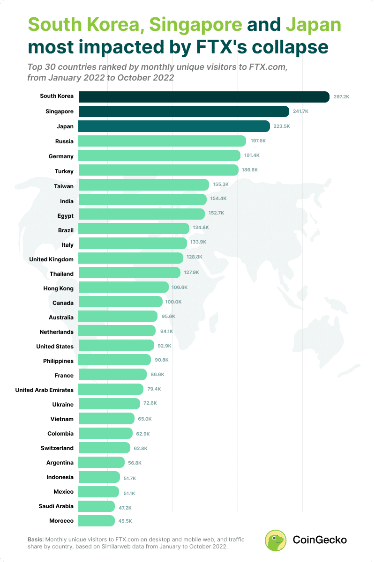

According to a new feature from Coingecko, South Korea, Singapore and Japan are the countries most affected by the FTX fallout. Over the past few years, the crypto-currency exchange FTX has been licensed to operate by several countries in Europe, Asia, America and Australia.

Thus, multiple investigations into the FTX implosion are simultaneously taking place in various jurisdictions. Meanwhile, centralized crypto-currency exchanges are trying to show their ingenuity by providing proof of reserve on the blockchain, which was initiated by Binance.

Nonetheless, FTX users have not been assured of getting their money back, and they are likely to continue waiting for years. Some market strategists say it may take decades to recover FTX funds. In addition, the Mt.Gox case, which is one of the most publicized crypto-currency heists, was never completed, more than eight years after the hack.

As fears of further forced liquidations in the crypto-currency market soar, crypto-currency prices continue to fall by the day. According to our latest crypto-currency price oracles, the price of bitcoin has dropped about 2% in the last 24 hours to trade around $15,700 at the time of the survey.

The price of Ethereum (ETH) has fallen about 3.2 percent in the past 24 hours to trade around $1088 today.

The majority of the current total crypto-currency trading volume emanates from the stablecoin market. An attribute of the high volatility of crypto-currencies as more and more traders take refuge.

Siemens issues 1st €60M bond on public blockchain

Siemens issues 1st €60M bond on public blockchain Wall Street on a tear: retail sales data drives the rise

Wall Street on a tear: retail sales data drives the rise Web3 instant messenger SendingMe raises $12.5M

Web3 instant messenger SendingMe raises $12.5M FLOKI doubles in value after Elon Musk tweet

FLOKI doubles in value after Elon Musk tweet Floki’s listing on Binance soon confirmed, here’s why, now might be the time to invest!

Floki’s listing on Binance soon confirmed, here’s why, now might be the time to invest!