The FTX contagion spread fairly quickly to all crypto-currency exchanges and investors opted to self-deposit. There have been massive outflows of bitcoin and stablecoins from exchanges following the FTX collapse.

According to Glassnode data, the rate of bitcoin exits from exchanges is so high that all of the BTC that has flowed into exchanges since 2018 has now been withdrawn. The demand for self-deposited, spot-focused bitcoin markets is growing rapidly. While bitcoin has been through several bear markets in the past, this type of behavior is unprecedented.

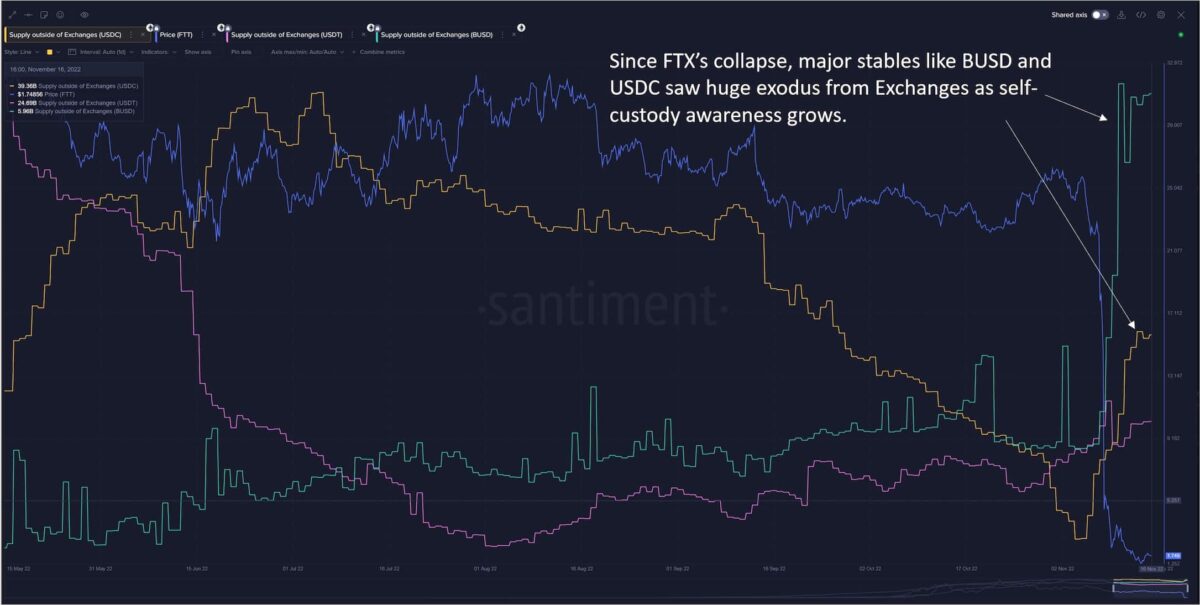

In addition to bitcoin, last week saw a massive exit from the exchanges of popular stable currencies like BUSD and USDC. All of these stable currencies have been transferred in large numbers to the self-depository. In its recent report, on-chain data provider Santiment writes:

The beginning of the year was quite positive as we saw the influx of the major stablecoins (USDC, BUSD, USDT) into the cryptocurrency market, suggesting that new funds are coming in to perhaps buy the bottom (as prices were falling). The market capitalization of the major stables finally peaked at $134.07 billion around the same time that BTC and ETH peaked this year. Since then, the trend has been downward, accelerated by the announcement of the FED’s first 75 basis point hike in June.

In addition, there has been a massive reshuffling of stablecoin holdings since Binance announced that they would convert USDC stablecoins to BUSD. “If there is one major lesson that recent events have taught us, it is self-defense. The market is learning quickly, as we have seen huge spikes in off-trade supply for the USDC and BUSD recently “, notes Santiment.

Is crypto really dead?

The FTX contagion has spread quite quickly and several players in the crypto space have been heavily impacted. Crypto venture capital fund Multcoin Capital faced losses of around $1 billion holding its assets on FTX.

The way the crypto market has collapsed has led many to wonder if crypto is really dead. However, cases like FTX have happened in the past, with exchanges like Mt. Gox collapsing overnight.

The fact that people are opting to self hold instead of selling their coins shows that they still believe in good crypto projects, blockchain and the concept of decentralization. However, there have certainly been some short-term headwinds, such as institutional players selling their BTC after the FTX collapse, but it would be too early to say if crypto is truly dead at this point. At $800 billion, it’s still a huge market.

Siemens issues 1st €60M bond on public blockchain

Siemens issues 1st €60M bond on public blockchain Wall Street on a tear: retail sales data drives the rise

Wall Street on a tear: retail sales data drives the rise Web3 instant messenger SendingMe raises $12.5M

Web3 instant messenger SendingMe raises $12.5M FLOKI doubles in value after Elon Musk tweet

FLOKI doubles in value after Elon Musk tweet Floki’s listing on Binance soon confirmed, here’s why, now might be the time to invest!

Floki’s listing on Binance soon confirmed, here’s why, now might be the time to invest!